Who are the European PIR panel suppliers?

In the context of the rapid development of building energy conservation and cold chain logistics, PIR panel (polyisocyanurate foam board) has become a “star product” in the global thermal insulation material market with its excellent thermal insulation performance, fire rating and lightweight advantages. As the birthplace of PIR technology, Europe not only has a mature industrial chain, but also gathers a group of technologically advanced and experienced suppliers. This article will outline the core players of European PIR panel suppliers and focus on analyzing the differentiated advantages of China Canglong Group in the international market.

Ⅰ. European PIR panel suppliers: technological accumulation and market pattern

Europe is at the forefront of global PIR material research and application, and its suppliers can be divided into two categories: comprehensive chemical giants and vertical enterprises specializing in insulation materials. The former relies on the advantages of the entire chemical industry chain and has a deep technical reserve. The latter focuses on specialized fields and forms differentiated competitiveness.

1. BASF, Germany

As one of the world’s largest chemical companies, BASF’s PIR business is an extension of its core technology in the field of polyurethane (PU). Its PIR panel adopts a “one-step” continuous production line, with a thermal conductivity coefficient as low as 0.022W/(m · K) and a fire rating of B1 (EN 13501-1). BASF’s advantage lies in the synergy of the entire industry chain, with independent supply of isocyanate raw materials (such as MDI), foaming agents, and flame retardants, and strong cost control capabilities. In addition, its products have passed multiple certifications such as EU CE and German T Ü V, and are widely used in high-end commercial buildings and industrial insulation fields.

2. Saint Gobain, France

Saint Gobain’s PIR panel business belongs to its “Insulation Materials Division”, with the core product being “ISOVER PIR”. Unlike BASF, Saint Gobain emphasizes more on “systematic services”. Not only does it provide boards, but it also comes with auxiliary materials such as adhesives and anchors, and provides customized insulation solutions for different climate zones (such as cold regions and humid environments). Its advantage lies in the accumulation of engineering experience, participation in multiple benchmark projects such as the renovation of the Paris Opera House and the European Green Building Certification (LEED/BREEAM), and high customer trust.

3. Alucore, Italy

Alucore is a typical representative of small and medium-sized PIR enterprises in Europe, focusing on the research and development of aluminum foil composite PIR boards. Its product solves the problem of delamination in traditional composite boards by optimizing the bonding process between aluminum foil layer and PIR core material, increasing compressive strength by 20% and reducing weight by 15%. The advantage of Alucore lies in its flexible customization – it can adjust the thickness (30-200mm), width (900-1200mm), and even surface texture of the board according to customer needs, especially favored by small builders and cold chain equipment manufacturers.

4. Kingspan, Ireland

Kingspan is one of the world’s largest suppliers of insulation boards, and its PIR products are known for their “ultra-thin and efficient” performance. For example, Kingspan’s Optimo series PIR sandwich panel thickness of only 50mm can achieve the insulation effect of traditional materials of 100mm, greatly saving building space. Its core competitiveness lies in R&D investment. Every year, 5% of its revenue is used for the development of new technologies (such as aerogel composite PIR). Its products lead the certification rate in the European Union’s “Passive House” standard.

Ⅱ. Canglong Group: A Breakthrough in the European Market for Chinese PIR Panel Suppliers

Although European suppliers have a first mover advantage in technology and brand, China’s PIR industry has rapidly risen in recent years. Among them, Canglong Group has gradually opened up its market in Europe with the triple advantage of “technology+cost+service”.

1. Technical advantages

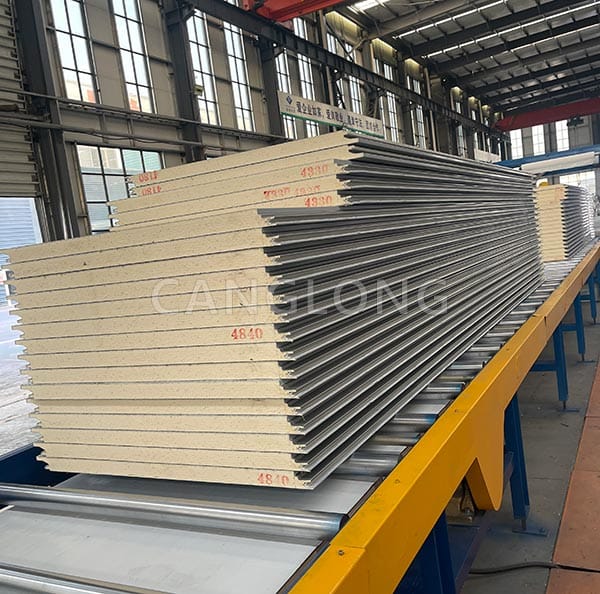

Canglong Group was established in 2008. In the early days, it mainly acted as an agent for European PIR equipment. Later, through reverse engineering and independent research and development, it mastered the core production technology of PIR panels. The independently developed “continuous foaming production line” adopts precise temperature control technology (temperature fluctuation ≤± 1 ℃), which solves the industry pain point of “uneven bubble holes” in traditional production lines. At the same time, through the development of the “fluorine free foaming agent” technology in cooperation with domestic universities, the product’s ODP (Ozone Depletion Potential) is 0, which meets the requirements of the European Union’s Montreal Protocol. At present, Canglong has obtained CE certification, ISO 9001 quality system certification, and passed the fire performance test (B1 level) of T Ü V in Germany.

2. Cost advantage

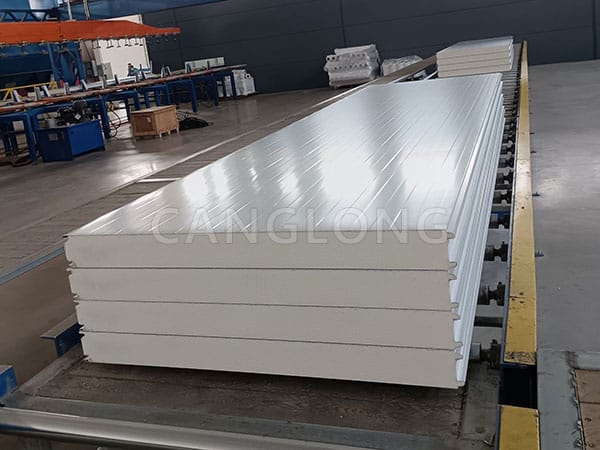

The production cost of PIR panel in Europe is generally high (mainly due to labor, energy, and environmental inputs), while Canglong relies on China’s well-established industrial support and large-scale production to reduce unit costs by 30% -40%. For example, its standard PIR board with dimensions of 1000mm × 2000mm × 100mm is priced at only 65% of similar products in Europe, but its insulation performance (thermal conductivity of 0.024W/(m · K)) is completely comparable to its fire rating (B1 level). This price advantage makes it highly competitive in small and medium-sized construction projects in Europe.

3. Service advantages

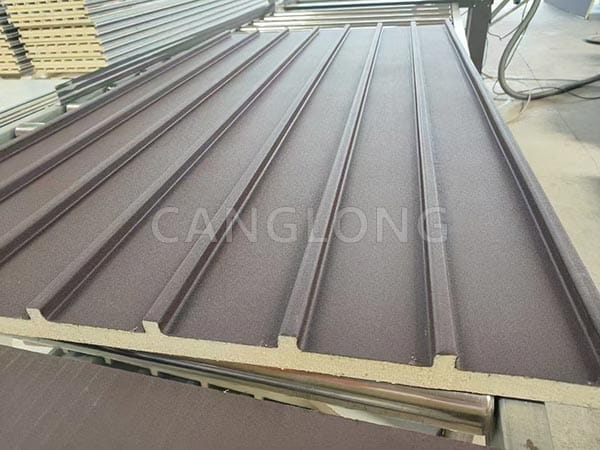

In response to the high response speed requirements of European customers, the delivery cycle from order placement to delivery is only 20 days (usually 25-30 days for local European suppliers), and a full process service of “on-site measurement customized production installation guidance” is provided. In addition, Canglong has launched a “trade in” policy, allowing customers to offset the cost of new European brand PIR panels proportionally with discarded ones. This not only reduces customer costs but also solves the material recycling problem in the European market.

4. Certification and case studies

Canglong’s products have entered the mainstream European market, with cooperative clients including the cold chain warehouse renovation project of German chain supermarket ALDI and the cold chain logistics center in northern French ports. Its PIR panel has passed certifications such as the EU CE-PED (Pressure Equipment Directive) and EN 14509 (Metal Faced Composite Plates). These qualifications not only break the bias of European customers towards Chinese products, but also become a “passport” for them to expand their market.

Ⅲ. New Trends in the European PIR Market

European PIR panel suppliers still dominate the high-end market with their technological accumulation and brand advantages. Chinese companies such as Canglong Group have formed differentiated competitiveness in the mid to low end market through technological innovation, cost optimization, and service upgrades. In the future, with the global demand for insulation materials upgrading towards “efficiency, low-carbon, and customization”, Chinese and European suppliers may move from “competition” to “cooperation”. For example, European companies provide raw materials and technology, while Chinese companies are responsible for production and regional market coverage, jointly exploring emerging markets.

For the purchaser, when selecting PIR panel suppliers, it is necessary to consider project requirements comprehensively. If we focus on brand and extreme environmental performance, European giants are still the first choice. If pursuing cost-effectiveness and fast delivery, Chinese companies such as Canglong Group provide more attractive solutions. This’ China Europe PIR panel dispute ‘is essentially a microcosm of the global insulation material industry upgrading.